Late payment of CP204 and underestimated the tax estimation. The key changes are outlined below.

Ccs 十面埋伏 Llp 有限责任合伙公司8 Llp 没有交到cp204 怎么办 1 Facebook

This should be beyond 30 days before the basis period starts.

. The Postponement of Estimated Tax Payable CP204 and Instalment Payment Scheme CP500 will be given automatically to qualified taxpayers with the status of micro small and medium enterprises MSMEs or PMKS from Jan 1 to June 30 2022. CP204 FYE April 2021 CP204A-6 FYE Sep 2020 CP204-9 FYE June 2020 Corporate Tax Estimate Return. You can apply for a tax number at the nearest office at the companys correspondence address or at any IRBM office convenient to you without reference to the companys correspondence address.

Postponement of 6 monthly tax instalments. A partner in you should use the form and these instructions to determine the proper amounts to include on your Form IT-2041 on an aggregate basis see Form IT-204-I Instructions for Form IT-204 page 15 Partnerships instructions for Form IT-2041 and on any Form IT-204-CP you complete for a partner of your own see. For companies that were newly incorporated the tax payable estimate must be given within 3.

Microenterprises and small and medium enterprises MSMEs are allowed to defer. The monthly instalment payment will begin on the 6th month of the basis period for the Year of Assessment 2019 which is from September 2019 to May 2020. With effect from YA 2008 where a SME first commences operations in a year of assessment the SME is not required to furnish an estimate of tax payable or make instalment payments for a period of two years beginning from the year of assessment.

5How to do for the revision of CP204. If you agree with the changes we made Correct the copy of your tax return that you kept for your records. The first accounting period ended on 30112019 8 months.

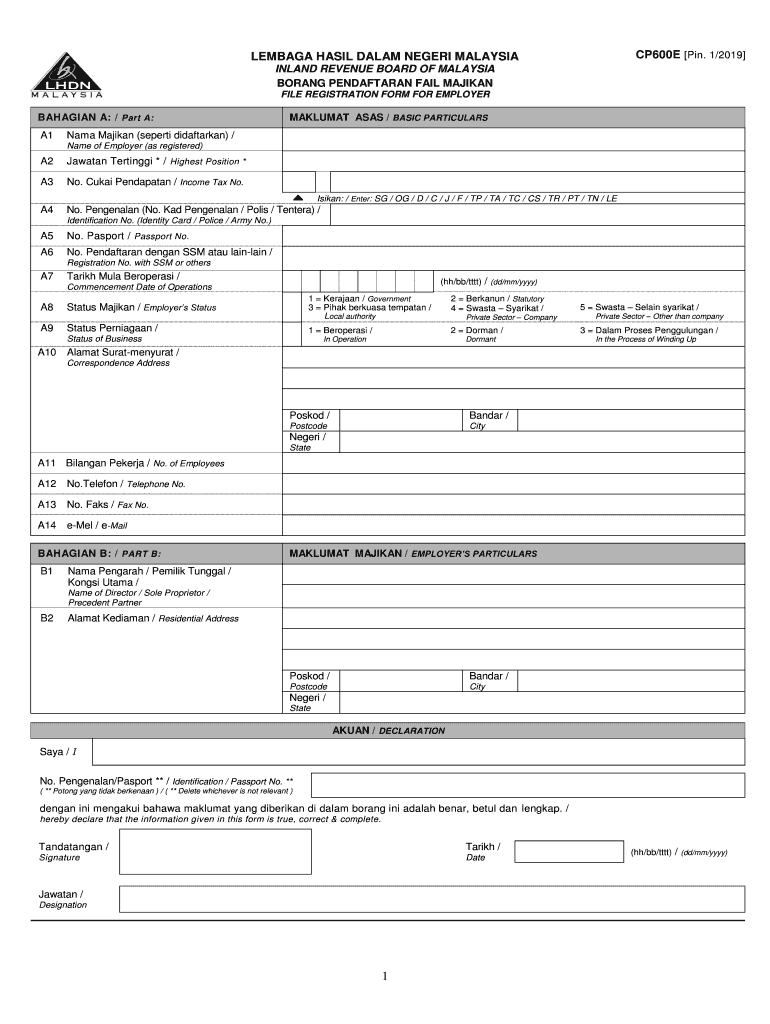

Furthermore the IRBM has announced that companies are required to furnish Form CP204 and CP204A via e-Filing with effect from the Year of Assessment 2018 as required under the provision of subsection 107C 1A of the Income Tax Act 1967 ITA 1967. Deferment of CP204 Payment 2022. Melayu Malay 简体中文 Chinese Simplified Estimate of Tax Payable in Malaysia.

Read your notice carefully. Was established on 2522019 and commenced business operation on 142019. The physical Forms CP204 and CP204A are not deemed received for the purposes of subsection 107C.

Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. After registration you must send the e-CP204 for tax estimation within 3 months from the date. The basis period of Dedaun Lebar for YA 2019 is from 172018 until 3062019.

The estimate of tax payable for the YA 2022 and YA 2023 shall not be less than 85 based on the latest revised estimate of the tax estimate or the revised tax estimate in accordance with S 107 C 3 of the ITA 1967. Company is required to submit CP204 within 3 months from the date of commencement. Compare the payments on the notice to your records.

ECOVIS MA LAY S I A Visc Company is required to submit CP204 Not later than 30 days before the beginning of the basis period for a year of assessment. FAQs on the revision of estimate of tax payable in the 11 th month of the basis period and the deferment of CP204 and CP500 payments. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian.

CP204 Due Date of the Submission Monthly Instalment based on Form CP205. CP204 is the prescribed form for initial submission for estimated tax payable. 31 Implementation Tax Amendment in the 3rd Month of Installments That Fall in The Calendar Year 2020.

TC0602019TBA 19 July 2019 The Piano Piano Sdn. 31 March 2020 submission. 9 Jalan USJ 33C 47600 Subang Jaya Selangor Darul Ehsan THE.

Under subsection 1201f of the Income Tax Act 1967 taxpayer is liable to a fine of RM200 RM20000 or to imprisonment for a term not exceeding six months. What is the consequences for non-submission late payment of CP204 and underestimated the tax estimation. What is CP204.

It will explain the changes we made to your return. Verify we listed all your estimated tax payments. You can register online for submitting tax estimation.

Companies that have been allowed for deferment of CP204 payment for the period from 1 January 2022 to 30 June 2022 are also. Dedaun Lebar has to furnish Form CP204 to the DGIR not later. View CP204 - August 2020doc from ACCOUNTING 12345 at Open University Malaysia.

The company is allowed to do the revision of an estimate of tax payable on 6th month or 9th month or both by using the Revised Estimate of Tax Payable Form CP204A through the electronic medium. The company must determine and submit the tax payable estimation for an assessment year through Form CP204. Permohonan Pindaan Anggaran Cukai Pada Bulan Ke-11 Tempoh Asas bagi Tahun Taksiran 20212022 Borang Permohonan Pindaan Anggaran Cukai Bulan Ke.

CP204 Form electronically through internet. This page is also available in. All businesses are allowed to revise their income tax estimates in the 11 th month of the basis period before 31 October 2022 and.

Form CP 15E - 12019 Available in Malay language only. FORM CP204 CP204A. Check the payments we applied if any from the prior year.

LEMBAGA HASIL DALAM NEGERI MALAYSIA Pusat Pemprosesan Aras 10 18 Menara C Persiaran MPAJ Jalan Pandan Utama Pandan. Example 4 - Form CP204 furnished by an existing business operation Dedaun Lebar a trust body commenced business operations since 2010 and closes its business accounts on 30 June annually. CP205 was issued by the DGIR to Era Gemilang Sdn Bhd on 1562018 as the company from ACCOUNTING AC110 at Universiti Teknologi Mara.

32 Implementation Postponement of CP204 Payment for a period of Six 6 Months Starting 1st April 2020 Until 30th September 2020 extended to 31st December 2020 under National Short-Term Economic Plan announce on 5th. The company must submit e-CP204 for the. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

The new Guidelines clarify that companies co-operative societies trust bodies and limited liability partnerships LLP collectively referred to as relevant entities that have ceased operations or are dormant are still required to submit an estimate of tax payable Form CP204. 3 months CP204 payment deferment ALL SMEs Business Tax instalment payment due from April to June. ANGGARAN CUKAI YANG KENA DIBAYAR OLEH SYARIKAT PERKONGSIAN LIABILITI TERHAD BADAN AMANAH KOPERASI No.

This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia.

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

2019 2022 Form My Cp600e Fill Online Printable Fillable Blank Pdffiller

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Cp204 Form Fill Online Printable Fillable Blank Pdffiller

Irbm S Guideline On Tax Estimate 3rd Month Revision And Deferment Cheng Co Group

E Filing Of Form Cp204 And Cp204a Taxation Latest News

Cp204 Form Fill Online Printable Fillable Blank Pdffiller

What Is Cp204 Cp204 Vs Cp204a Sql Payroll

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Cp204 Form Fill Online Printable Fillable Blank Pdffiller

What Is Cp204 Cp204 Vs Cp204a Sql Payroll

Taxplanning Tax Measures Announced During The Mco The Edge Markets